All Categories

Featured

Table of Contents

- – Accredited Investor Passive Income Programs

- – Premium Real Estate Investments For Accredited...

- – All-In-One Passive Income For Accredited Inve...

- – Unparalleled Real Estate Investments For Accr...

- – Favored Accredited Investor Investment Returns

- – First-Class Top Investment Platforms For Acc...

- – Respected Accredited Investor Secured Invest...

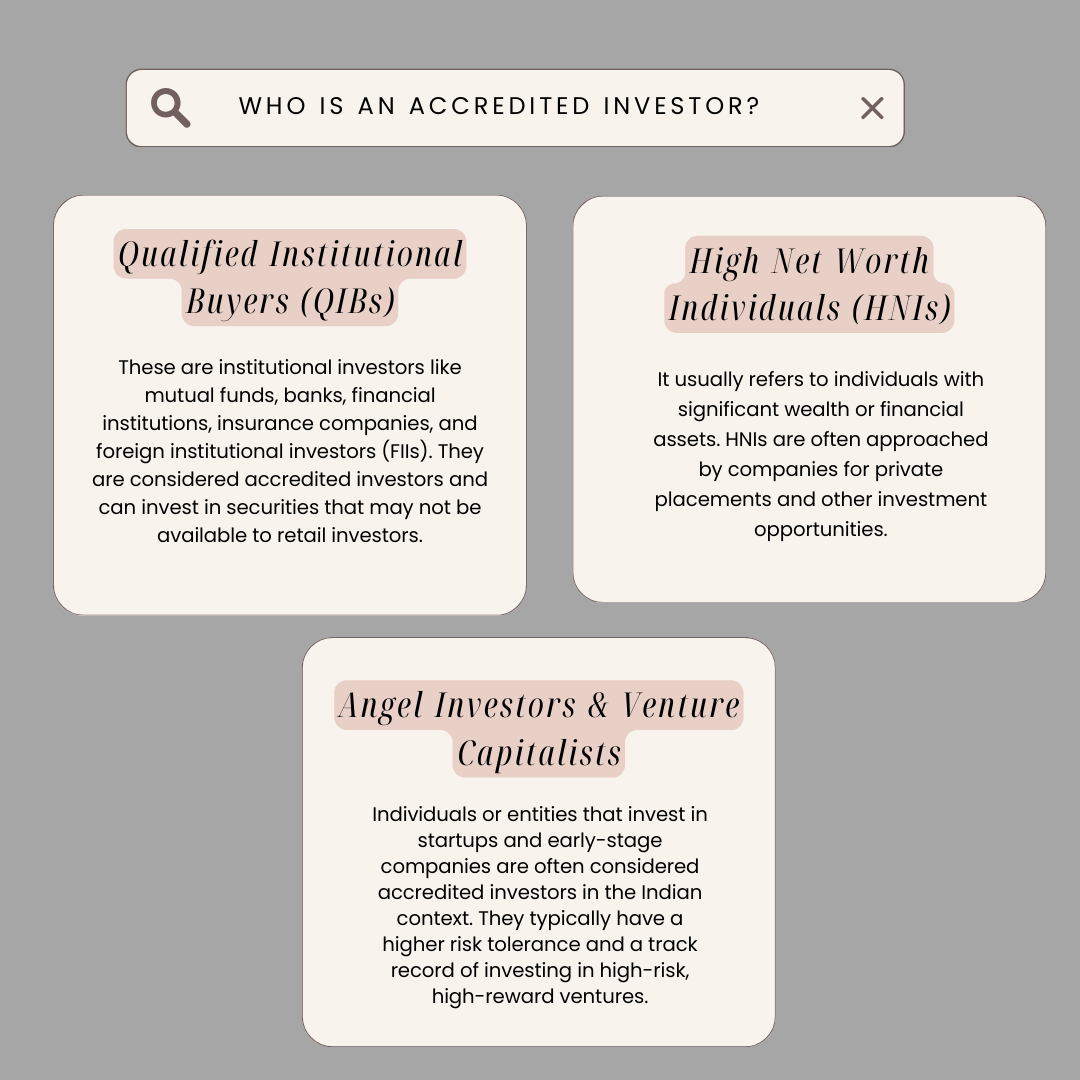

The laws for recognized investors differ among territories. In the U.S, the interpretation of a recognized investor is presented by the SEC in Guideline 501 of Law D. To be an accredited investor, a person has to have an annual income exceeding $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of earning the very same or a greater revenue in the current year.

An approved capitalist ought to have a net well worth going beyond $1 million, either independently or jointly with a spouse. This quantity can not include a primary home. The SEC also thinks about candidates to be accredited financiers if they are basic companions, executive policemans, or supervisors of a firm that is issuing non listed safety and securities.

Accredited Investor Passive Income Programs

Additionally, if an entity contains equity proprietors that are recognized capitalists, the entity itself is a recognized capitalist. Nevertheless, a company can not be developed with the single purpose of purchasing details safety and securities - accredited investor alternative investment deals. An individual can certify as a recognized investor by showing sufficient education or work experience in the monetary market

People that intend to be accredited financiers do not put on the SEC for the classification. Instead, it is the duty of the company providing a personal placement to make certain that every one of those approached are recognized capitalists. People or events who wish to be certified capitalists can approach the issuer of the non listed safety and securities.

For instance, suppose there is an individual whose earnings was $150,000 for the last three years. They reported a main house worth of $1 million (with a home mortgage of $200,000), a vehicle worth $100,000 (with a superior lending of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Web well worth is determined as possessions minus responsibilities. He or she's net well worth is precisely $1 million. This involves a calculation of their properties (various other than their primary residence) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto loan amounting to $50,000. Considering that they satisfy the total assets requirement, they certify to be a certified financier.

Premium Real Estate Investments For Accredited Investors for Wealth-Building Solutions

There are a couple of much less usual credentials, such as handling a count on with more than $5 million in properties. Under federal safety and securities laws, only those who are certified capitalists may join certain securities offerings. These might include shares in private placements, structured products, and private equity or hedge funds, to name a few.

The regulatory authorities wish to be specific that participants in these highly dangerous and intricate financial investments can fend for themselves and judge the dangers in the absence of federal government security. The certified financier regulations are made to secure potential capitalists with limited monetary knowledge from adventures and losses they may be ill furnished to stand up to.

Certified investors meet credentials and professional standards to gain access to unique investment chances. Accredited capitalists have to meet revenue and internet well worth demands, unlike non-accredited people, and can spend without constraints.

All-In-One Passive Income For Accredited Investors for Accredited Investment Portfolios

Some crucial changes made in 2020 by the SEC consist of:. This change acknowledges that these entity kinds are typically made use of for making financial investments.

This adjustment make up the results of inflation over time. These amendments broaden the certified investor pool by around 64 million Americans. This broader access gives extra possibilities for investors, however likewise raises possible threats as less financially sophisticated, investors can get involved. Businesses making use of exclusive offerings might gain from a larger pool of prospective capitalists.

These financial investment choices are special to recognized investors and institutions that certify as an accredited, per SEC laws. This offers recognized capitalists the chance to invest in arising firms at a stage before they take into consideration going public.

Unparalleled Real Estate Investments For Accredited Investors

They are viewed as financial investments and come just, to qualified customers. In addition to known firms, certified financiers can choose to purchase startups and up-and-coming ventures. This provides them tax returns and the chance to go into at an earlier phase and potentially reap benefits if the company succeeds.

However, for financiers available to the dangers entailed, backing start-ups can result in gains. Much of today's technology business such as Facebook, Uber and Airbnb came from as early-stage startups supported by recognized angel financiers. Sophisticated financiers have the opportunity to explore investment choices that may produce more profits than what public markets provide

Favored Accredited Investor Investment Returns

Although returns are not guaranteed, diversification and profile improvement alternatives are broadened for financiers. By expanding their portfolios via these increased financial investment methods accredited investors can improve their methods and potentially accomplish superior long-term returns with proper danger administration. Experienced capitalists commonly encounter investment options that may not be quickly available to the basic investor.

Investment alternatives and safety and securities offered to approved investors normally include greater dangers. Exclusive equity, venture resources and hedge funds often focus on spending in properties that lug threat however can be sold off conveniently for the possibility of greater returns on those dangerous investments. Researching prior to spending is important these in scenarios.

Lock up durations stop financiers from withdrawing funds for even more months and years on end. Capitalists may have a hard time to precisely value personal assets.

First-Class Top Investment Platforms For Accredited Investors for High Returns

This change might prolong certified capitalist status to a variety of people. Updating the income and possession benchmarks for rising cost of living to guarantee they mirror adjustments as time progresses. The existing thresholds have remained fixed given that 1982. Permitting partners in committed relationships to integrate their sources for shared eligibility as accredited financiers.

Allowing individuals with certain professional qualifications, such as Collection 7 or CFA, to qualify as accredited financiers. This would certainly identify financial class. Developing added requirements such as proof of economic literacy or successfully finishing an accredited investor test. This might make certain capitalists recognize the threats. Restricting or removing the main residence from the total assets estimation to reduce possibly filled with air assessments of wide range.

On the other hand, it could additionally result in skilled capitalists presuming extreme risks that might not be appropriate for them. Safeguards might be needed. Existing accredited financiers may deal with boosted competitors for the very best investment possibilities if the pool grows. Firms elevating funds may benefit from a broadened recognized financier base to attract from.

Respected Accredited Investor Secured Investment Opportunities

Those that are currently taken into consideration accredited financiers have to stay upgraded on any type of alterations to the requirements and regulations. Their eligibility could be based on modifications in the future. To preserve their condition as certified financiers under a modified definition adjustments might be needed in riches management strategies. Businesses looking for recognized financiers ought to stay alert concerning these updates to ensure they are drawing in the ideal audience of capitalists.

Table of Contents

- – Accredited Investor Passive Income Programs

- – Premium Real Estate Investments For Accredited...

- – All-In-One Passive Income For Accredited Inve...

- – Unparalleled Real Estate Investments For Accr...

- – Favored Accredited Investor Investment Returns

- – First-Class Top Investment Platforms For Acc...

- – Respected Accredited Investor Secured Invest...

Latest Posts

Tax Lien Investing Scam

Investing In Tax Lien Certificate

2020 Delinquent Real Property Tax

More

Latest Posts

Tax Lien Investing Scam

Investing In Tax Lien Certificate

2020 Delinquent Real Property Tax